The culinary landscape is undergoing a silent but profound transformation, one delivery bag at a time. In the hushed, fluorescent-lit spaces of industrial parks and repurposed buildings, a new breed of restaurant is flourishing, one that exists almost entirely in the digital ether. This is the world of the ghost kitchen, a culinary concept that has dismantled the traditional brick-and-mortar dining model and rebuilt it for the on-demand age.

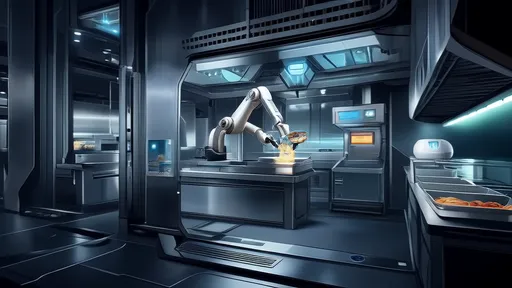

At its core, a ghost kitchen—also known as a virtual kitchen, dark kitchen, or cloud kitchen—is a professional food preparation facility designed for the delivery-only meal. It is a restaurant without a restaurant. There are no charming waitstaff, no ambient lighting, no clatter of cutlery, and no front-of-house at all. The entire operation is a back-of-house, a hyper-efficient engine room whose sole purpose is to craft meals that travel well and arrive at a customer's door looking and tasting as the chef intended. The customer interface is not a physical menu or a hostess stand but a smartphone app or a website, with brands living or dying by their digital presence and customer reviews.

The rise of this model is inextricably linked to a perfect storm of technological and cultural shifts. The proliferation of third-party delivery apps like DoorDash, Uber Eats, and Grubhub has fundamentally rewired how consumers think about food. A restaurant meal is no longer an experience that requires leaving one's home; it is a commodity that can be summoned with a few taps. This digital marketplace provided the storefront. Meanwhile, soaring real estate costs in urban centers made the traditional restaurant model, with its requirement for prime location and expensive dining space, increasingly precarious for entrepreneurs. The ghost kitchen emerged as an elegant, capital-efficient solution, allowing culinary businesses to operate from lower-rent districts, focusing their investment entirely on high-quality ingredients and skilled kitchen labor rather than on mahogany bars and designer decor.

The operational advantages are compelling. By eliminating the dining room, these kitchens can achieve a radical reduction in overhead costs. There's no need to invest in tables, chairs, elaborate point-of-sale systems, or a large front-of-house staff. This lean structure allows for greater flexibility and experimentation. A single ghost kitchen facility can host multiple different virtual brands under one roof, each with its own unique menu, branding, and digital storefront. A kitchen specializing in high-quality chicken, for instance, might simultaneously operate a Nashville hot chicken brand, a rotisserie chicken brand, and a chicken wing brand, effectively capturing different segments of the market from the same physical location. This allows operators to test new concepts with minimal risk, adapting quickly to culinary trends without the burden of a full rebrand.

For chefs and entrepreneurs, the ghost kitchen model is a double-edged sword offering both liberation and intense pressure. It dramatically lowers the barrier to entry into the food industry. A talented chef with a brilliant idea for a burger or a bowl no longer needs hundreds of thousands of dollars to build out a full-service restaurant. They can rent space in a commissary kitchen, develop a menu optimized for travel, and launch their brand to the world virtually overnight. This democratization of food service has unleashed a wave of culinary innovation. However, this freedom comes with its own set of challenges. Without a physical presence, building brand loyalty is exceptionally difficult. Competition on the delivery apps is fierce and often boils down to a thumbnail image and a star rating. These businesses live and die by the algorithms of the delivery platforms, which can dictate their visibility and, by extension, their success.

The impact on the consumer experience is equally nuanced. On one hand, diners benefit from an unprecedented explosion of choice. Their local options are no longer limited to restaurants within a short driving distance; they now have access to a plethora of specialized virtual brands that may operate from a kitchen across town. It caters perfectly to the desire for convenience and variety. On the other hand, the experience is wholly transactional. The romance of dining out—the atmosphere, the human interaction, the immediate presentation of a dish—is entirely absent. The meal's quality is also at the mercy of the delivery process, a variable the kitchen cannot fully control. A perfectly crispy piece of fried chicken can be rendered soggy by a ten-minute delay in a courier's car, separating the kitchen from the final moment of truth for the customer.

Looking forward, the trajectory of the ghost kitchen phenomenon is a subject of intense speculation. Some industry analysts believe they represent the future of a significant portion of the restaurant industry, particularly for fast-casual cuisine. Others see a market correction on the horizon, where only the most efficient and highest-quality virtual brands will survive the initial gold rush. The model is also evolving. We are now seeing the emergence of ghost kitchen franchises and large-scale, purpose-built facilities that resemble logistics hubs more than traditional kitchens. Furthermore, some established restaurant chains are launching virtual-only spin-off brands to capture additional delivery market share without cannibalizing their dine-in traffic.

In conclusion, the ghost kitchen is far more than a pandemic-era stopgap or a passing fad. It is a fundamental restructuring of the food service business model, born from the marriage of digital technology and changing consumer habits. It has democratized food entrepreneurship and expanded choices for consumers, all while stripping away the traditional social rituals of dining. As this sector continues to mature and consolidate, it will undoubtedly continue to shape what we eat, how we access it, and the very definition of a restaurant in the 21st century. It is a quiet revolution, happening not on bustling high streets, but in the anonymous spaces in between, its success measured not in filled seats, but in delivered orders.

By /Aug 29, 2025

By /Aug 29, 2025

By /Aug 29, 2025

By /Aug 29, 2025

By /Aug 29, 2025

By /Aug 29, 2025

By /Aug 29, 2025

By /Aug 29, 2025

By /Aug 29, 2025

By /Aug 29, 2025

By /Aug 29, 2025

By /Aug 29, 2025

By /Aug 29, 2025

By /Aug 29, 2025

By /Aug 29, 2025

By /Aug 29, 2025

By /Aug 29, 2025

By /Aug 29, 2025

By /Aug 29, 2025

By /Aug 29, 2025